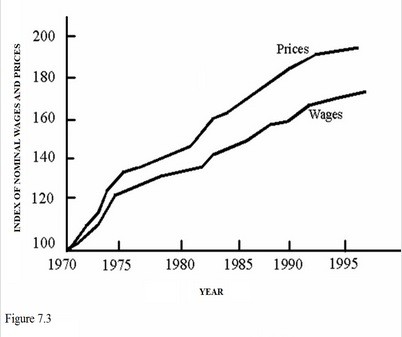

According to Figure 7.3, prices and wages were rising, so

According to Figure 7.3, prices and wages were rising, so

A. There were no redistributive effects of inflation.

B. Sellers of output were better off than wage earners.

C. The economy was experiencing stagflation.

D. Everyone must have been worse off since the price level rose faster than incomes.

Answer: B

You might also like to view...

According to this Application, falling home equity values have decreased consumer wealth, which is a measure of a consumer's

A) total net worth. B) annual income. C) annual income minus total expenses. D) annual income minus annual expenses.

The law of diminishing marginal returns states that

A) as both labor and capital are increased, output increases at a decreasing rate. B) output increases at a decreasing rate as more capital is added. C) output decreases at a constant rate as more capital is added. D) as both labor and capital are increased, output does not change. E) output increases at a constant rate as more capital is added.

Refer to Scenario 5.10. If Hillary invests 30 percent of her savings in the real estate project and remainder in Treasury bills, the standard deviation of her portfolio is:

A) 0 percent. B) 12 percent. C) 28 percent. D) 30 percent. E) 40 percent.

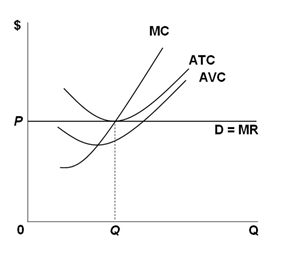

Consider the purely competitive firm pictured below. At its short-run equilibrium point, the firm is earning:

A. Zero normal profits

B. Zero economic profits

C. Zero accounting profits

D. We can say nothing about this firm's profit or loss situation