Which of the following is most likely to reduce an individual's current spending?

A) Paying back a loan in the future

B) Depositing money in a bank today

C) Borrowing money today

D) Withdrawing money in the future

B

You might also like to view...

The original Federal Reserve Act

A) specified open market operations as the Fed's main policy tool. B) specified open market operations as one of several Fed policy tools. C) specified that open market operations be employed by the Fed only in circumstances where discount loans were ineffective. D) did not specifically mention open market operations.

Monetarists and classical economists:

a. assume that stimulative monetary policy will create high levels of GDP without inflation. b. assume that stimulative monetary policy will create high levels of GDP and slightly high prices. c. assume the economy operates at full employment and stimulative monetary policy will only cause the price level to rise. d. assume that the economy operates at full employment and stimulative monetary policy will increase both aggregate supply and aggregate demand. e. assume that the Keynesian description of monetary policy underestimates the true stimulative effect of an increase in the money supply.

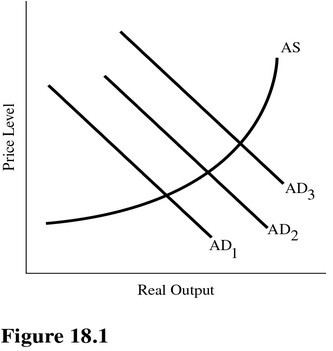

Refer to Figure 18.1. Which of the following would most likely cause a shift from AD1 to AD2?

Refer to Figure 18.1. Which of the following would most likely cause a shift from AD1 to AD2?

A. A decrease in the money supply through open market operations. B. An increase in transfer payments because of a recession. C. A decrease in government spending. D. An increase in the tax rate.

Refer to the following game.Firm AFirm B??Low PriceHigh Price?Low Price(9,10)(8,15)?High Price(-7,10)(11,11)Which of the following is true?

A. There does not exist a dominant strategy for firm A. B. A dominant strategy for firm B is "low price." C. A dominant strategy for firm A is "high price." D. None of the answers is correct.