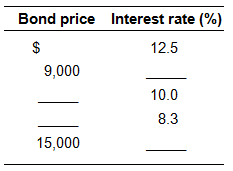

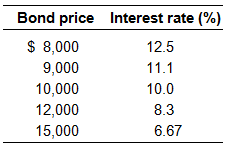

Suppose that a bond having no expiration date has a face value of $10,000 and pays a fixed amount of interest of $1000 annually. Compute and enter in the spaces provided either the effective interest rate which a bond buyer could receive at the new price or the bond price (rounded to the nearest $1000) required to receive the interest rate shown.

You might also like to view...

If the Fed reduces the supply of bank reserves, ________

A) investment increases B) consumption increases C) the federal funds rate increases D) the federal funds rate falls

In the money market, if the quantity of money supplied exceeds the quantity of money demanded, the nominal interest rate will ________ and the prices of assets will ________

A) fall; increase B) rise; increase C) fall; decrease D) rise; decrease E) fall; not change

Money coming into a business is called ________. Examples include tickets, broadcast contracts, concessions, and sponsorships.

a. profit b. expenses c. revenue d. income e. debt

Millionaires tend to be older than the general population because

a. the earnings of most people peak during the retirement phase of life. b. older workers generally have more education than younger workers. c. many achieve millionaire status by saving from a relatively modest income, and this will take a lengthy period of time. d. older people have less to do, and therefore, they have more time to come up with innovative ideas