Recently, there has been talk about reforming the tax system. Some advocate replacing the current income tax with a consumption tax. The income tax taxes interest earned on savings directly, while a consumption tax doesn't. Assuming the demand curve for loanable funds is unchanged, which of the following would most likely occur?

a. a decline in the interest rate and an increase in the quantity of loanable funds demanded and supplied

b. an increase in the interest rate and a decrease in the quantity of loanable funds demanded and supplied

c. no effect on the interest rate, but a decline in the quantity of loanable funds demanded and supplied

d. an increase in both the interest rate and quantity of loanable funds demanded and supplied

e. an increase in the interest rate but no effect on the quantity of loanable funds demanded and supplied

A

You might also like to view...

An example of Friedman's k-percent rule is

A) "do not change the growth rate of the quantity of money." B) "every time GDP decreases, decrease the growth rate of the quantity of money." C) "set the growth rate of the quantity money equal to the unemployment rate." D) "every time GDP decreases, increase the growth rate of the quantity of money." E) "use all information available to determine the growth rate of the quantity of money each time GDP changes."

When a monopoly price discriminates, it

A) increases the amount of consumer surplus. B) decreases its economic profit. C) converts consumer surplus into economic profit. D) converts economic profit into consumer surplus. E) has no effect on the deadweight loss in the market.

If the tax on each Snicker's bar is 10 percent of its price, than that tax is a

a. sales tax b. unit tax c. corporate tax d. progressive tax e. estate tax

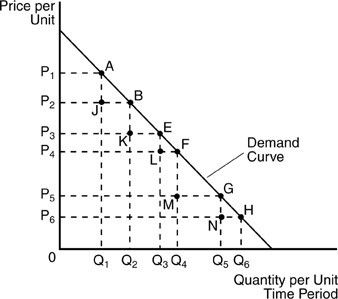

In the above figure, through which range would the demand for this good be most inelastic?

In the above figure, through which range would the demand for this good be most inelastic?

A. B-E B. G-H C. A-B D. E-F