Using an appropriate diagram, discuss the importance of side and forward overlaps in aerial photography.

What will be an ideal response?

Side and forward overlaps are critical for stereoscopic viewing of aerial

photographs. In order for the aerial photographs to be viewed in three dimensions,

an object should be viewed by the observer’s left eye on the left photograph and

the same object viewed by the observer’s right eye on the right photograph on a

set of stereopairs. This requires that each object in the area be on at least two

aerial photographs. This is achieved through the side overlap which provides for

approximately 60 percent overlap in the direction of flight, and the overlap in the

direction perpendicular to flight which provides for about 25 percent overlap as

shown in Figure 14.6 in the text.

You might also like to view...

The shaded-pole motor has a low starting torque and ____.

a. running torque b. rotation c. linear acceleration d. mass

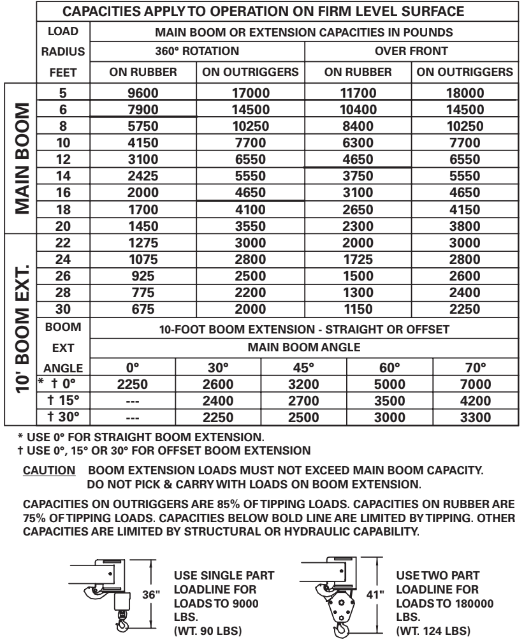

Referring to the Broderson IC-80-1G industrial crane load chart shown in Figure 1, find the net capacity in the following configuration:

• On-rubber lift

• Over-side lift

• Lifting on main boom, no extension

• Load radius of 14.7 feet

a. 1,695 lb

b. 1,725 lb

c. 1,785 lb

d. 1,910 lb

Technician A says that the MSDS is available from the manufacturers and suppliers of chemicals. Technician B says that employees should be trained in the use of the MSDS. Who is correct?

A. A only B. B only C. Both A and B D. Neither A nor B

For the nonconventional net cash flow series experienced over the first 3 years of operation by Viking, Inc., an Internet-based sports boat and ski equipment sales company, perform a thorough ROR analysis for the owners, Julie Merkel and Carl Upton, to include the following:

(a) Application of sign tests to determine the number and nature of the roots to the ROR equation.

(b) All real-number i* values between ?100% and +100% using the IRR function.

(c) A plot of PW versus i values indicating the i* values found in part (b).

(d) The EROR values using the MIRR method at an investment rate of 10% and various borrowing rates ranging from 4% to 14%, in 2% increments (Viking does not know currently what it will cost to borrow additional funds, if needed).

(e) The EROR value using the ROIC method at the same 10% per year investment rate.

( f ) Before you started your analysis, the owners told you they expected to realize at least a 25% per year return. With this MARR and your results, develop a short written summary for Julie and Carl’s review and understanding of the different ROR values and interpretations, that is, for all of the i*, i?, and i? values. Tell them if they are meeting their MARR.

FIGURE 1.png)