You are trying to design a tax system that will simultaneously achieve both of the following goals: 1) two people with the same total income would pay taxes of the same amount, and 2) a high-income person would pay a higher fraction of income in taxes than a low-income person. Which of the following tax systems could achieve both goals?

a. a lump-sum tax

b. a regressive tax

c. a progressive tax

d. a proportional tax

c

You might also like to view...

This Application showed that

A) the WTO can affect the actions of member countries, but rapid resolution of disputes requires ongoing negotiations between countries. B) decisions by the WTO can lead to further conflicts between countries. C) it may take years for decisions by the WTO to take effect. D) all of the above

Since price tends to equal total utility, the price of water is low and the price of diamonds is high.

Answer the following statement true (T) or false (F)

Crowding out is least likely to occur when deficit government spending is financed through

A) taxation. B) reductions in consumption. C) monetary expansion. D) reductions in investment.

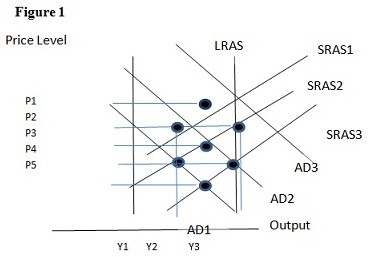

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the short run would be:

A. P1 and Y2. B. P3 and Y1. C. P2 and Y2. D. P2 and Y3.