It is not uncommon to read about highly successful mutual fund managers that spend considerable amounts of time visiting the companies that they have placed their clients' funds with. What might be the motive(s) behind these visits?

What will be an ideal response?

The chapter discussed ways to reduce moral hazard and one way was through monitoring. These visits may accomplish a number of things but one is to let the managers of the corporations know that the manager of the mutual fund is paying attention to see that the firms are using the funds in the ways they stated. For example, the mutual fund manager may look to see if the president's office is overly ornate, or if excessive amounts are being spent on non- productive assets. The mutual fund manager may also look to see if the company's facilities are operating at or close to capacity or if it appears that an excessive amount of inventory is on hand.

You might also like to view...

If the quantity of wood purchased decreases when the price of wood rises, a graph representing these variables would have

A) time on the vertical axis. B) the slope on the vertical axis. C) a negative slope. D) a positive slope.

Why would a company be more enthusiastic in providing more training to its workers during an economic downturn than during an economic boom (assuming that they do not layoff their workers and can keep them when the economy recovers)?

What will be an ideal response?

Which of the following could increase unemployment and inflation simultaneously?

A) a decrease in the real wage B) an increase in oil prices C) expansionary monetary policy D) contractionary monetary policy

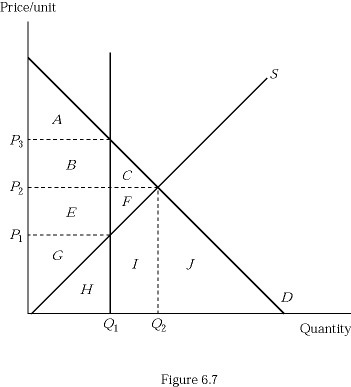

In Figure 6.7 at equilibrium, consumer surplus is area:

In Figure 6.7 at equilibrium, consumer surplus is area:

A. A. B. A + B + C. C. E + F + G. D. G.