A proportional tax results in:

A. a larger percentage of income going to taxes as income rises.

B. the same percentage of income going to taxes for all taxpayers.

C. the same dollar amount going to taxes for all taxpayers.

D. a smaller percentage of income going to taxes as income rises.

Answer: B

You might also like to view...

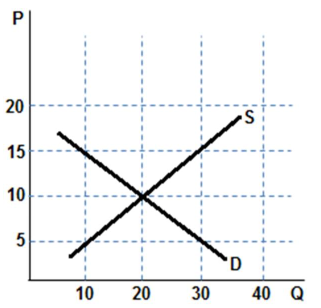

According to the graph shown, at a price of $15, there is a:

A. shortage of 10.

B. shortage of 20.

C. shortage of 30.

D. surplus of 20.

If the exchange rate of the Swiss franc is 1.61 francs per dollar, then the Swiss franc is worth about

a. 15 cents. b. 57 cents c. 62 cents. d. $15.70.

Which statement is false?

A. The spreading use of electricity during the 1920s helped create rapid economic expansion in that decade. B. The stock market rose very rapidly in the late 1920s. C. Between 1921 and 1929 national output rose by 50 percent. D. None of the statements are false.

The run up in gasoline prices between 1999 and 2007

A. still had them much below their long-term inflation-adjusted average. B. put them about the same as their long-term inflation-adjusted average. C. still had them slightly below their long-term inflation-adjusted average. D. put them much above their long-term inflation-adjusted average.