Explain how an increase in American interest rates will lead to an appreciation of the U.S. dollar vis-à-vis the British pound

Americans will demand fewer pounds, because of the higher investment return in the U.S. Therefore, less

money will be available for investments in Great Britain. Meanwhile, the British will supply more pounds,

because they will want to make more investments in the United States due to the higher American interest

rates. Greater demand for dollar-denominated investments will lead to a dollar appreciation. Conversely, it

will take fewer dollars to buy a pound.

You might also like to view...

If a nation opens up to free trade and becomes an importer of goods, which of the following is then true?

A) The nation as a whole loses. B) Sellers gain. C) Buyers gain. D) Buyers lose.

Refer to the scenario above. A player should use ________ to play this game

A) forward induction B) backward induction C) mixed strategies D) his dominated strategy

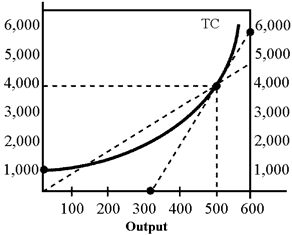

Figure 7-2

In Figure 7-2, average cost at 500 units of output equals

a.

4,000.

b.

200.

c.

8.

d.

6.

Which of the following is an effect of a minimum wage law that establishes a wage floor above the current market clearing? wage?

A) surplus labor, or unemployment

B) a decrease in the market clearing wage

C) a decrease in the quantity of labor supplied

D) an increase in the quantity of labor supplied