An investment project has an expected profit rate of 12 percent. The going rate of interest is 12 percent. Firm X would need to borrow money to carry out this project; firm Y would use its own funds. Which statement is true?

A. Firm X would undertake the project; Firm Y would not.

B. Neither firm would undertake this project.

C. Both firms would undertake this project.

D. Firm Y would undertake the project; Firm X would not.

Answer: D

You might also like to view...

Because it is more extensive, first-degree price discrimination is more profitable for the firm than is third-degree price discrimination

Indicate whether the statement is true or false

Subprime mortgage

What will be an ideal response?

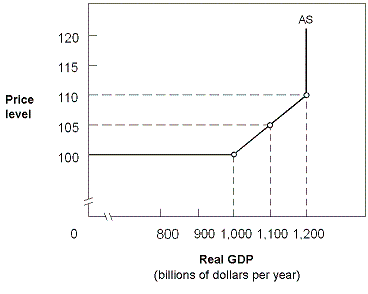

Exhibit 10-6 Aggregate supply curve

A. everyone willing to work at the current wage is employed. B. the economy has reached full employment. C. GDP can increase to $1,100 billion without triggering an increase in the price level. D. no further increases in the price level can generate more real GDP.

Which statement is true?

A. The United States' economic system leads to an equitable distribution of income. B. One of the basic functions of the United States' government is to transfer some income from the rich and the middle class to the poor. C. The price mechanism and the definition of economics are incompatible. D. None of the statements are true.