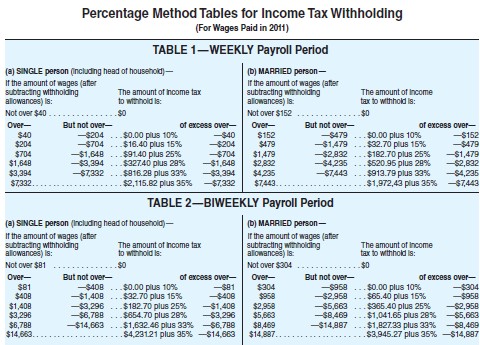

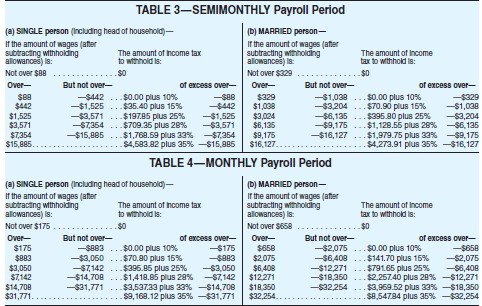

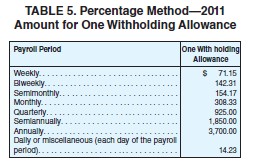

Use the percentage method of withholding to find the federal withholding tax, a 6.2% FICA rate to find the FICA tax, and 1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over $110,000 so far this year.

Fred Jones has gross earnings of $4723.08 biweekly. He is married and has 2 withholding allowances.

Fred Jones has gross earnings of $4723.08 biweekly. He is married and has 2 withholding allowances.

A. $3987.56

B. $5097.29

C. $3626.25

D. $4361.77

Answer: C

Mathematics

You might also like to view...

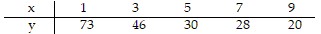

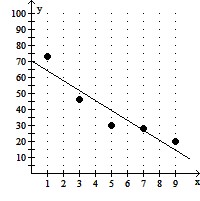

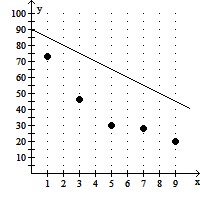

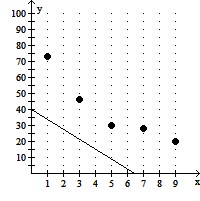

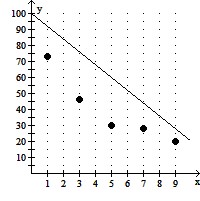

Find the equation of the least-squares regression line. Graph the line and data points on the same graph.

A. y = 70.4 - 6.2x

B. y = 90.0 - 5.0x

C. y = 40.0 - 6.25x

D. y = 100.4 - 6.2x

Mathematics

Find the specified minor and cofactor for the matrix A.M11 and A11 if A =

A. M11 = 24 and A11 = 24 B. M11 = 24 and A11 = - 24 C. M11 = 23 and A11 = 23 D. M11 = -23 and A11 = -23

Mathematics

Solve the system using the inverse of the coefficient matrix of the equivalent matrix equation. 9x - y + 4z = 20 2x + 4y + 3z = 15 4x - 9y + z = -9

A. {(-2, 2, 4)} B. ? C. {(2, 1, 2)} D. {(2, 2, 1)}

Mathematics

Find the sum.

A. 363 B. 364 C. 202 D. 355

Mathematics