To totally internalize an externality, a government can levy a tax related only to the physical quantity of pollution if

A. the economic damages associated with the pollution are the same across different locations.

B. the economic damages are too large to be determined.

C. the economic damages are zero.

D. the economic damages associated with the pollution are different across different locations.

Answer: A

You might also like to view...

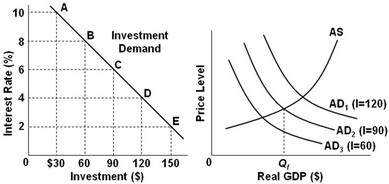

Use the following graphs to answer the next question. In the graphs, the numbers in parentheses near the AD1, AD2, and AD3 labels indicate the level of investment spending associated with each curve, respectively. All numbers are in billions of dollars. The interest rate and the level of investment spending in the economy are at point B on the investment demand curve. To achieve the long-run goal of a noninflationary, full-employment output of Qf in the economy, the Fed should ________.

In the graphs, the numbers in parentheses near the AD1, AD2, and AD3 labels indicate the level of investment spending associated with each curve, respectively. All numbers are in billions of dollars. The interest rate and the level of investment spending in the economy are at point B on the investment demand curve. To achieve the long-run goal of a noninflationary, full-employment output of Qf in the economy, the Fed should ________.

A. increase investment spending from $30 billion to $60 billion B. decrease the interest rate from 8% to 6% C. decrease the interest rate from 10% to 8% D. decrease the interest rate from 6% to 4%

In this situation the monopoly's profit maximizing output level is:

a. 0.2. b. 0.4. c. 0.5. d. 0.7.

Imposing a tax on an activity that generates an external benefit will cause participants in the activity to increase the amount of the activity undertaken

a. True b. False

If German imports of French products are very important in determining the volume of German exports to France, we would expect the actual German spending multiplier to be larger than 1/(marginal propensity to save + marginal propensity to import)

a. True b. False Indicate whether the statement is true or false