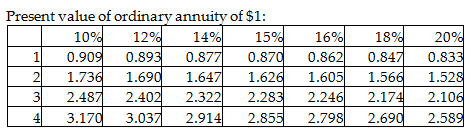

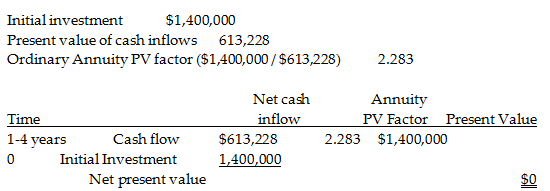

A company is considering an iron ore extraction project that requires an initial investment of $1,400,000 and will yield annual cash inflows of $613,228 for three years. The company's discount rate is 9%. Calculate IRR.

A) 15%

B) 17%

C) 14%

D) 13%

A) 15%

You might also like to view...

Sutton Products is a price-setter that uses the cost-plus pricing approach. The products are specialty vacuum tubes used in sound equipment. The CEO is certain that the company can produce and sell 310,000 units per year, due to the high demand for the product. Variable costs are $2.40 per unit. Total fixed costs are $970,000 per year. The CEO will receive stock options if $100,000 of operating income for the year is reported. What sales price would allow the CEO to achieve the target if the cost-plus pricing method is used? (Round your answer to the nearest cent.)

A) $2.40 per unit B) $5.85 per unit C) $3.45 per unit D) $5.21 per unit

Committed fixed costs would include:

A. contributions to charitable organizations. B. advertising. C. depreciation on buildings and equipment. D. research and development. E. expenditures for direct labor.

Tie-in arrangements are considered to be a violation of the antitrust laws when the:

a. company insisting on the tie-in has monopoly power b. company insisting on the tie-in interferes with pre-existing contracts of the buyer c. buyer interferes with pre-existing contracts of the seller d. buyer is fully integrated vertically e. none of the other choices

According to an InformationWeek survey, the majority of security challenges for corporations include

A) managing the complexity of security. B) preventing data breaches from outside attackers. C) enforcing security policies. D) all of the above.