Harris, who owes Nathan $4,000, sells Bethany a used car for $5,000, payable in 30 days. Harris immediately tells Nathan that she doesn't have the money she owes him, but she is willing to give him her claim to Bethany's $5,000. Nathan agrees and gives up his claim against Harris for $4,000, and Harris notifies Bethany of the assignment. In this case, Bethany is best described as the

A. assignee.

B. assignor.

C. obligor.

D. obligee.

Answer: C

You might also like to view...

Credit risk means the same thing as

A. withdrawal risk. B. default risk. C. interest-rate risk. D. foreign-exchange risk.

Issuance of stock results in cash inflows that appear in the financing section of the statement of cash flows

a. True b. False Indicate whether the statement is true or false

Answer the following statements true (T) or false (F)

1. SMART is an acronym that represents characteristics necessary to motivate employees in their periodic reviews. 2. The "R" in a SMART goal stands for "reachable." 3. A bike messenger company that operates in the downtown area of a large city recently set the following goal: "All deliveries should be completed as quickly as possible." This example meets the criteria for a SMART goal. 4. SMART goals that are challenging yet can be met within the available scope of time, equipment, and financial support are known as attainable, the "A" in SMART.

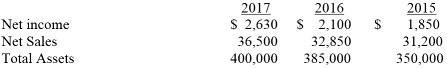

From the information provided, calculate Giuseppe's profit margin ratio for each of the three years. Comment on the results, assuming that the industry average for the profit margin ratio is 6% for each of the three years.

What will be an ideal response?