A firm should use marginal analysis when making a price-output decision.

Answer the following statement true (T) or false (F)

True

You might also like to view...

Assume that you own an exhaustible resource that is sold competitively. The price of the resource is:

Pt + 1 - C = 1.08(Pt - C), where t = 0 at the beginning of 2005, P = price in dollars per ton, and C = marginal cost of extraction (fixed over time). It is also known that the demand for the resource is: Q = 1,000,000 - 25,000 P, where Q represents output in tons per year. If the beginning of 2005 price is $30 per ton and the marginal cost of extraction is $10 per ton, what will the price be at the end of 2009? What is the user cost of production in 2009? Is it different from the user cost for 2005? Explain. How much of the resource will be extracted in 2009? What is the market rate of interest on money? Explain.

"The optimal level of pollution is zero." Do you agree or disagree? Why?

What will be an ideal response?

You have $1,000 in your checking account at Generous Savings and Loan (GSL). GSL holds $300 of your money in reserve and makes a $700 student loan to Wilma, who promises to repay the loan with interest. Wilma now has an additional $700 in her checking account. By how much has the money supply M1 increased?

a. $2,000 b. $1,700 c. $1,000 d. $700

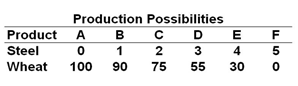

A nation can produce two products: steel and wheat. The table below is the nation's production possibilities schedule:

Refer to the above table. The marginal opportunity cost of the third unit of steel is:

A. 18.3 units of wheat

B. 25 units of wheat

C. 20 units of wheat

D. 55 units of wheat