A bond that is callable has a chance of being retired earlier than its stated term to maturity. Therefore, if the yield curve is upward sloping, an outstanding callable bond should have a lower yield to maturity than an otherwise identical noncallable bond.

Answer the following statement true (T) or false (F)

False

Rationale: The callable bond will be called if rates fall far enough below the coupon rate, but it will not be called otherwise. Thus, the call provision can only harm bondholders. Therefore, callable bonds sell at higher yields than noncallable bonds, regardless of the slope of the yield curve.

You might also like to view...

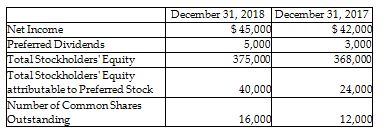

Perkins Services reported the following balances:

Compute earnings per share for 2018, price/earnings ratio for 2018, assuming the market price on December 31, 2018 is $37.50 per share, and the rate of return on common stockholders' equity for 2018.

(Show your computations and round to two decimal places.)

One-third of the steel units ________ sold, but that one ________

A) have been/wasn't B) been/weren't C) have been/weren't D) been/wasn't

A sale of treasury stock may result in a decrease in paid-in-capital. All decreases should be charged to the Paid-In-Capital from Sale of Treasury account

Indicate whether the statement is true or false

The transfer of ‘back office’ organisational functions such as IT, HRM, finance and accounting to an overseas service provider is referred to as which of the following:

a. business process re-engineering b. task specialisation c. functional flexibility d. business process outsourcing