Suppose the demand for macaroni is inelastic, the supply of macaroni is elastic, the demand for cigarettes is inelastic, and the supply of cigarettes is elastic. If a tax were levied on the sellers of both of these commodities, we would expect that the burden of

a. both taxes would fall more heavily on the buyers than on the sellers.

b. the macaroni tax would fall more heavily on the sellers than on the buyers, and the burden of the cigarette tax would fall more heavily on the buyers than on the sellers.

c. the macaroni tax would fall more heavily on the buyers than on the sellers, and the burden of the cigarette tax would fall more heavily on the sellers than on the buyers.

d. both taxes would fall more heavily on the sellers than on the buyers.

a

You might also like to view...

Rob took the afternoon off from his job as a tire salesman to mow his lawn. Rob told his wife that this made sense because he would be saving the $50 he would have to pay a lawn service, noting that this would be the opportunity cost to the family. Rob’s wife disagreed. What did Rob’s wife say?

A. The opportunity cost would be Rob’s lost income from selling tires that afternoon plus the $50. B. The opportunity cost would be Rob’s lost income from selling tires that afternoon minus the $50. C. That Rob just wanted to take the afternoon off. D. The opportunity cost would be Rob’s lost income from selling tires that afternoon.

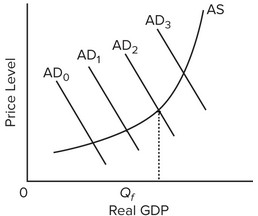

Use the following graph to answer the next question. In the diagram, Qf is the full-employment output. A contractionary fiscal policy would be most appropriate if the economy's present aggregate demand curve were at

In the diagram, Qf is the full-employment output. A contractionary fiscal policy would be most appropriate if the economy's present aggregate demand curve were at

A. AD0. B. AD1. C. AD2. D. AD3.

________ is defined as any attempt to capture consumer surplus, producer surplus or economic profit

A) Search B) Rent seeking C) Maximizing monopoly profits D) Price discrimination

Income on the horizontal axis at which the vertical distance to the 45-degree line is less than the vertical distance to the Ep line gives rise to a ________ amount of unplanned inventory investment, and thus ________ pressure on output

A) positive, upward B) positive, downward C) negative, upward D) negative, downward