AGI is

A. found by subtracting certain business expenses from H-S income.

B. found by subtracting exemptions from taxable income.

C. not used in modern tax policy.

D. none of these answer options are correct.

A. found by subtracting certain business expenses from H-S income.

You might also like to view...

In the 2-factor, 2 good Heckscher-Ohlin model, the two countries differ in

A) tastes and preferences. B) military capabilities. C) the size of their economies. D) relative abundance of factors of production. E) labor productivities.

A Consumer Price Index adjustment overcompensates for inflation because it ignores

A) the income effect when relative prices change. B) the substitution effect when relative prices change. C) that some goods are inferior. D) that the substitution effect may offset the income effect.

If prices (as measured by the CPI) fell by one-half and nominal wages fell by one-third, what would happen to real wages?

a. They would fall by one-third b. They would remain unchanged c. They would decrease d. They would increase e. They would fall by one-half

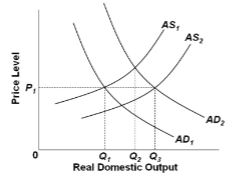

Refer to the diagram. If the aggregate supply curve shifted from AS 0 to AS 1 and the aggregate demand curve remains at AD 0 , we could say that:

A. aggregate supply has increased, equilibrium output has decreased, and the price level has

increased.

B. aggregate supply has decreased, equilibrium output has decreased, and the price level has increased.

C. an increase in the amount of output supplied has occurred.

D. aggregate supply has increased and the price level has risen to G.