On September 30, Waldon Co. has $540,250 of accounts receivable. Waldon uses the allowance method of accounting for bad debts and has an existing credit balance in the allowance for doubtful accounts of $13,750.

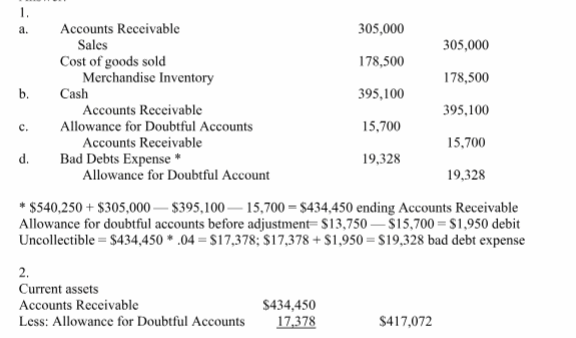

1. Prepare journal entries to record the following selected October transactions. The company uses the perpetual inventory system. 2. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its October 31 balance sheet.

a. Sold $305,000 of merchandise (that cost $178,500) to customers on credit.

b. Received $395,100 cash in payment of accounts receivable.

c. Wrote off $15,700 of uncollectible accounts receivable.

d. In adjusting the accounts on October 31, its fiscal year-end, the company estimated that 4.0% of accounts receivable will be uncollectible.

You might also like to view...

Which of the following is true about a pull communication strategy?

A) It uses uses channel marketing instead of direct marketing. B) It is directed at end-users. C) It uses tools such as sales incentives and co-op advertising. D) It motivates retailers to carry a particular product or brand. E) It aims to build the interest, purchase, inventory, and marketing efforts of its intermediaries.

The business marketer normally deals with far fewer but far larger buyers than the consumer marketer does

Indicate whether the statement is true or false

During a presentation, your eye contact:

a. should be exclusively on the most important decision maker b. should be almost exclusively on the most important decision maker c. should almost never be for as long as 15 – 30 seconds d. none of the above

Gilligan Corporation was established on February 15, Year 1. Gilligan is authorized to issue 500,000 shares of $6.00 par value common stock. As of December 30, Year 1, Gilligan's stockholders' equity accounts report the following balances: Common stock, $6 par, 500,000 shares authorized 55,000 shares issued and outstanding$330,000 Paid-in capital in excess of par - Common 440,000 $770,000 Retained earnings 1,400,000 Total Stockholders' Equity $2,170,000 On December 31, Year 1, Gilligan decides to issue a 5% stock dividend. At the time of issue, the market price of the stock was $22 per share.How will the issuance of the stock dividend affect the financial statements?

A. Decrease the common stock account by $60,500, increase the retained earnings account by $16,500, and increase the paid-in capital in excess of par-Common B. Decrease the retained earnings account and increase the common stock account by $16,500. C. Decrease the retained earnings account by $60,500, increase the common stock account by $16,500, and increase the paid-in capital in excess of par-Common account by $44,000. D. Increase the dividends account and decrease the cash account by $108,500.