A problem that the Fed faces when it attempts to control the money supply is that

a. the 100-percent-reserve banking system in the U.S. makes it difficult for the Fed to carry out its monetary policy.

b. the Fed has to get the approval of the U.S. Treasury Department whenever it uses any of its monetary policy tools.

c. the Fed does not have a tool that it can use to change the money supply by either a small amount or a large amount.

d. the Fed does not control the amount of money that households choose to hold as deposits in banks.

d

You might also like to view...

The financial market shock which occurred during the recession of 2007-2009 increased the default-risk premium, causing the

A) IS curve to shift to the right. B) IS curve to shift to the left. C) MP curve to shift up. D) MP curve to shift down.

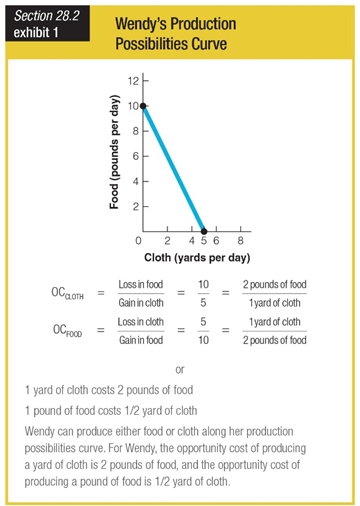

What is Wendy’s opportunity cost of producing a yard of cloth?

a. 3 pounds of food

b. 2 pounds of food

c. 1 pound of food

d. 1/2 pound of food

Expansionary fiscal policy that raises the budget deficit may:

A. increase business investment by reducing interest rates. B. reduce business investment by reducing interest rates. C. increase business investment by increasing interest rates. D. reduce business investment by increasing interest rates.

An explanatory variable is called exogenous if it is correlated with the error term.

Answer the following statement true (T) or false (F)