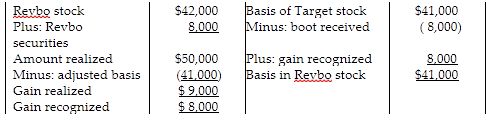

Carol owns Target Corporation stock having an adjusted basis of $41,000. As part of a Type C tax-free reorganization involving Revbo and Target Corporations, Carol exchanges her Target stock for $42,000 of Revbo stock and Revbo securities having a face amount and FMV of $8,000. What is Carol's basis in the Revbo stock?

What will be an ideal response?

You might also like to view...

A contribution margin income statement is formatted to emphasize cost behavior rather than organizational functions

Indicate whether the statement is true or false

If your supervising attorney wanted to expand his wills and estate practice to include elder law, what types of work might you find yourself doing?

What will be an ideal response?

The list of five S practices includes ________, ________, ________, ________ and ________

Fill in the blanks with correct word

Which of the following prohibits any firm from selling to two or more different buyers, within a reasonably short time, commodities (not services) of like grade and quality at different prices where the result would be to substantially lessen competition?

A. Sherman Act B. Federal Trade Commission Act C. Food and Drug Administration Act D. Anti-Discrimination Act E. Robinson-Patman Act