Suppose that Fly-By-Night Airlines, Inc. has a return of 5% twenty percent of the time and 0% the rest of the time. The expected return from Fly-By-Night is:

A. 1.0%.

B. 0.1%.

C. 10%.

D. 0.2%.

Answer: A

You might also like to view...

Which of the following rises when the U.S. price level falls?

a. interest rates b. the value of the dollar in the market for foreign-currency exchange c. real wealth d. All of the above are correct.

The period of growth in real GDP between the trough of the business cycle and the next peak is called the:

A. recessionary phase. B. expansionary phase. C. contractionary phase. D. cyclical phase.

If the government used the revenue from the excise tax on cigarettes to fund research on lung cancer treatment programs, this would be an example of

A. a benefits-received tax. B. an ability-to-pay tax. C. a vertical equity tax. D. a user fee.

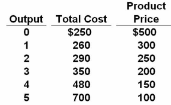

If the given profit-maximizing monopolist is able to price discriminate, charging each customer the price associated with each given level of output, how many units will the firm produce?

A. 2.

B. 3.

C. 4.

D. 5.