If government tax policy requires Peter to pay $15,000 in tax on annual income of $200,000 and Paul to pay $10,000 in tax on annual income of $100,000, then the tax policy is:

A. optional.

B. progressive.

C. proportional.

D. regressive

Ans: D. regressive

You might also like to view...

Suppose that the quantity of pizza demanded decreased by 15 percent after an increase in price of 10 percent. What is the price elasticity of demand for pizza?

A) 1.50 B) 0.67 C) -1.50 D) -0.67

Game theory suggests that in the trust game:

A. trustees will be untrustworthy and will forego potentially profitable investments. B. trustees will be trustworthy and will pursue all potentially profitable investments. C. trustees will be untrustworthy, but will pursue all potentially profitable investments. D. trustees will be trustworthy, but will forego potentially profitable investments.

An improvement in technology will shift a supply curve to the right

Indicate whether the statement is true or false

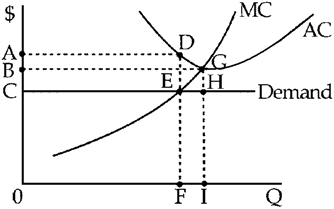

Figure 10-2

Figure 10-2 shows demand and short-run cost curves for a perfectly competitive firm. At its profit-maximizing output, the firm's total ____ is represented by area ____.

a.

loss; GBHC

b.

profit; ADGHC

c.

loss; ADEC

d.

profit; EGH