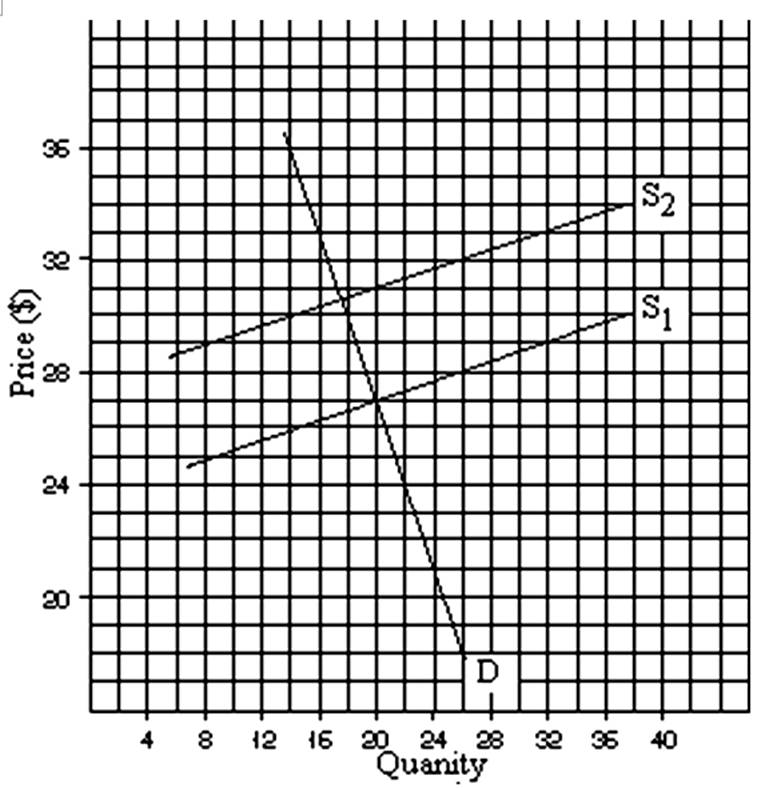

A. How much is the tax in the above graph? B. How much of this tax is borne by the buyer and how much is borne by the seller? C. As a result of the tax, by about how much does consumption fall?

(a) $4

(b) Buyer pays $3.50 and seller pays $.50

(c) about 2.7

You might also like to view...

Since an individual spends a small share of the income on salt, the elasticity of demand is likely to be low.

Answer the following statement true (T) or false (F)

In the long run, a year-long drought that destroys most of the summer's wheat crops causes permanently:

A. higher prices. B. lower output. C. lower prices. D. None of these is true.

All other things being equal among the banks below, which bank is the least likely to become insolvent?

A) Bank A with assets of $100 million and liabilities of $80 million. B) Bank B with assets of $100 million and liabilities of $70 million. C) Bank C with assets of $200 million and liabilities of $120 million. D) Bank D with assets of $400 million and liabilities of $310 million. E) Bank E with assets of $100 million and liabilities of $60 million.

Colorado experiences a record snowfall during the winter season. What impact will this have on the market for snowmobiles?

a. The supply of snowmobiles will increase and the price of snowmobiles will increase. b. The supply of snowmobiles will increase and the price of snowmobiles will fall. c. The demand curve for snowmobiles will decrease and the price of snowmobiles will fall. d. The demand curve for snowmobiles will increase and the price of snowmobiles will rise.