In the traditional Keynesian model, a cut in current taxes

A. has no effect on either disposable income or consumption.

B. decreases disposable income but increases consumption.

C. increases disposable income but does not affect consumption.

D. increases both disposable income and consumption.

Answer: D

You might also like to view...

An increase in demand will have what effect on equilibrium price and quantity?

A. Price will increase; quantity will decrease. B. Price will decrease; quantity will increase. C. Both price and quantity will increase. D. Both price and quantity will decrease.

An increased gas tax would result in ______.

a. more congestion on the road b. fewer vehicles on the road c. increased negative externalities d. more miles driven

Explain why a firm's shut-down decision does not incorporate the fixed costs of the production facility.

What will be an ideal response?

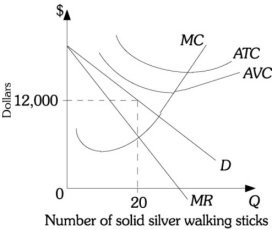

Refer to the information provided in Figure 13.5 below to answer the question that follows.  Figure 13.5 Refer to Figure 13.5. The Silver Exchange has a monopoly over the sale of solid silver walking sticks. The Silver Exchange has hired you as an economic consultant. You should advise this monopolist to

Figure 13.5 Refer to Figure 13.5. The Silver Exchange has a monopoly over the sale of solid silver walking sticks. The Silver Exchange has hired you as an economic consultant. You should advise this monopolist to

A. produce in the short run and expand capacity in the long run. B. shut down in the short run and exit the industry in the long run. C. shut down in the short run but expand capacity in the long run. D. produce in the short run but exit the industry in the long run.