Patrick's adjusted gross income for the year is $100,000. What is the amount of his charitable contribution deduction?

Patrick's records for the current year contain the following information:

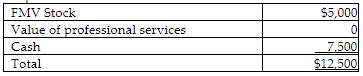

-He donated stock having a fair market value of $5,000 to a qualified charitable organization. Patrick acquired the stock two years ago at a cost of $3,000.

-He donated 20 hours of his time as a professional plumber to a qualified charitable organization. He bills his time to his customers at $50 per hour.

-He also donated $7,500 cash to a qualified charitable organization.

A) $10,500

B) $11,500

C) $12,500

D) $13,500

C) $12,500

You might also like to view...

In developing countries, which of the following scales would be best for measuring consumer preferences?

A) ordinal scales B) ratio scales C) interval scales D) substantive scales E) dichotomous scales

Hawaii enacts a state law that violates the U.S. Constitution. This law can be enforced by

A. no one. B. the federal government only. C. the state of Hawaii only. D. the United States Supreme Court only.

A court is much more likely to find a contract unconscionable when one party is a consumer than if the two parties are businesses.

Answer the following statement true (T) or false (F)

The three most common research tasks in integrated marketing communications are advertising effectiveness studies, sales tracking, and:

A. trade area analysis. B. in-store traffic patterns. C. attitudinal research. D. store image studies. E. location analysis.