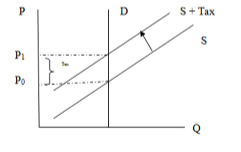

Suppose that demand is perfectly inelastic. Supply is normal and upward sloping. What is the economic incidence of a unit tax placed on suppliers? Illustrate this with an appropriate diagram.

What will be an ideal response?

The economic incidence of the tax is paid entirely by the consumers.

You might also like to view...

If a 15 percent reduction in the price of electricity per kilowatt hour has no impact on the total electricity consumption, we can infer that in the short run, the demand for electricity is _____

a. perfectly inelastic b. perfectly elastic c. unit-elastic d. relatively inelastic e. relatively elastic

Which of the following observations about outsourcing is true for the U.S. economy?

a. The U.S. is the smallest international outsourcer in terms of dollar value. b. About 30 percent of U.S. manufacturing costs were outsourced in 2003. c. The highest percentage of outsourcing by U.S. businesses in 2003 was to other firms located in the United States. d. Imports of business services by the U.S. made up around 2.5 percent of gross domestic product in 2003.

Which of the following best explains how income inequality is calculated?

a. Measure the gap between middle income families and the near-poor b. Compare those with middle incomes to those with low incomes c. Compare those with high incomes, middle incomes, and low incomes d. Estimate the income of those just above and just below the poverty line

When a firm has maximized profits

A) it has also minimized total costs. B) the marginal product of each input is also maximized. C) the marginal physical product is greater than the input price for all inputs. D) its marginal cost is zero.