A put option is a contract

A) that gives the owner the right, but not the obligation, to buy shares of a stock at a specified price within the time limits of the contract.

B) that gives the owner the right, but not the obligation, to sell shares of a stock at a specified price within the time limits of the contract.

C) in which the seller agrees to provide a particular good to the buyer on a specified future date at an agreed-upon price.

D) that gives the owner the right, but not the obligation, to buy or sell shares of a stock at a specified price within the time limits of the contract.

B

You might also like to view...

Use the following table to answer the question below. Giovanni's Production Possibilities ScheduleJorge's Production Possibilities SchedulePounds of Green BeansPounds of CornPounds of Green BeansPounds of Corn0160032040120202408080401601204060801600800If Giovanni and Jorge both specialize in the production of their respective low-cost goods, then the total production of corn equals ________ pounds and the total production of green beans equals ________ pounds.

A. 320, 320 B. 160, 320 C. 320, 160 D. 160, 160

The good for which neither the principle of mutual excludability nor the principle of rivalry applies is referred to as a:

a. public good. b. commons good. c. club good. d. normal good. e. private good.

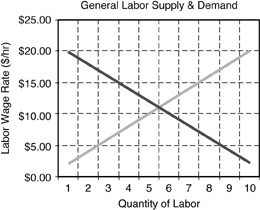

Refer to the above figure. Suppose the government imposes a minimum wage rate of $20.00 per hour. This will likely result in

Refer to the above figure. Suppose the government imposes a minimum wage rate of $20.00 per hour. This will likely result in

A. a shortage of labor. B. an equilibrium in the labor market. C. an increase in the demand for labor. D. a surplus of labor.

The Mass Rapid Transit (MRT) System in Hong Kong has been running significant losses. Transport Ministry officials have argued over whether to raise fares to combat the losses. One argument against a fare increase is that it will aggravate traffic

congestion on the streets during peak commuter hours. Suppose that the current fare is $4 and the government is considering raising it to $6. Officials estimate that this reduces the number of rides purchased from 10,000 to 8,000 per day. a. Using the midpoint formula, what is the estimated elasticity of demand for MRT rides? b. What does this elasticity of demand suggest to you about what will happen to total revenue earned by the transit system if the fare increase happens? c. Last year, the MRT system incurred a loss of $50,000 per day. Do you think the fare increase will resolve the deficit problem as well as Ministry officials anticipate? Explain. What will be an ideal response?