Beverage Merger Cott Corp markets a portfolio of beverages, bottled waters, beverage, and coffee delivery systems for homes and offices. In November, 2014, it has agreed to merge with DS Services of America, a water and coffee direct-to-consumer services provider. What is the expected effect of this merger on price-cost margins?

These two companies' products are primarily substitutes for each other. A price increase for one company would both affect own profits but also would shift some demand to the other and thereby increase the other's profits. Before the merger, the second effect would not have been captured by the firm raising prices. After the merger, it would. Therefore it is more willing to raise prices.

You might also like to view...

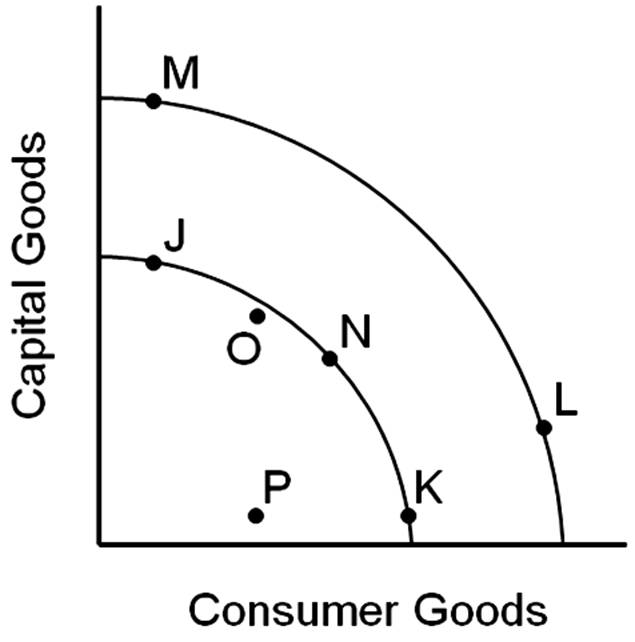

A movement from point N to point L would represent

A. an increase in both consumer goods and capital goods.

B. a decrease in both consumer goods and capital goods.

C. an increase in consumer goods, but a decrease in capital goods.

D. an increase in capital goods, but a decrease in consumer goods.

The aggregate supply curve can shift due to ___________ to input goods or labor.

a. dramatic changes b. minor changes c. reductions d. planned changes

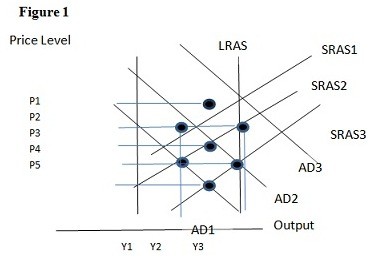

Using Figure 1 above, if the aggregate demand curve shifts from AD3 to AD2 the result in the short run would be:

A. P3 and Y1. B. P2 and Y1. C. P2 and Y3. D. P1 and Y2.

A risk-neutral individual would:

A. prefer a risky prospect with the expected value of $0.50 to $5 with certainty. B. be indifferent between a risky prospect with an expect value of $5 to a certain amount of $5. C. prefer a risky prospect with an expected value of $5 to a certain amount of $5. D. prefer $5 with certainty to a risky prospect with the expected value of $5.