If the demand for a good is price inelastic, a tax on it will

a. raise price, raise tax revenue, shift the supply curve to the right

b. lower price, lower tax revenue, shift the supply curve to the right

c. raise price, raise tax revenue, shift the supply curve to the right

d. raise price, raise tax revenue, shift the supply curve to the left

e. lower price, raise tax revenue, shift the demand curve to the left

D

You might also like to view...

Refer to Figure 17-2. The nonaccelerating inflation rate of unemployment, or NAIRU, is associated with which point rate in the figure above?

A) A B) B C) C D) all of the above

Consumers always ____ indifference curves that are farther from the origin

a. reject b. cross c. prefer d. maximize

According to the life-cycle theory of consumption, people tend to dissave during their retirement years.

Answer the following statement true (T) or false (F)

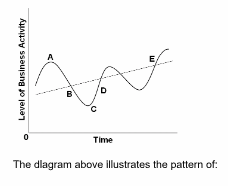

Refer to the diagram above. The straight line E drawn through the wavy lines would provide an estimate of the:

A. Recession fluctuation

B. Economic growth trend

C. Natural rate of unemployment

D. Recovery trend