If the U.S. interest rate is 5% and the interest rate in Germany is 2%, and the euro is expected to appreciate by 2% over the next year, then investors would:

a. sell dollars in the spot market.

b. buy euros.

c. seek to invest in the United States.

d. seek to invest in Germany.

Answer: c. seek to invest in the United States.

You might also like to view...

If the propensity to hold money is 6 and the money supply is 12, then the classical aggregate demand curve is

a. P = 2Y b. P/Y = 48 c. P = 1/(2Y) d. P = 2/Y

If total production of goods and services for a given quarter is $2,000 billion (seasonally adjusted), the GDP will be reported at an annual rate of

a. $750 billion. b. $1,500 billion. c. $5,000 billion. d. $8,000 billion.

During World War II,

a. government purchases of goods and services increased fivefold. b. the economy's production increased about 25 percent. c. unemployment fell to about 5%. d. All of the above are correct.

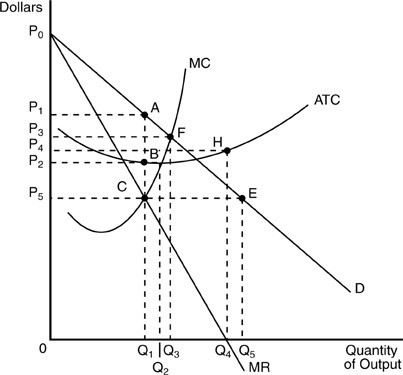

In the above figure, marginal cost and marginal revenue are equal at output

In the above figure, marginal cost and marginal revenue are equal at output

A. Q1. B. Q5. C. Q3. D. Q2.