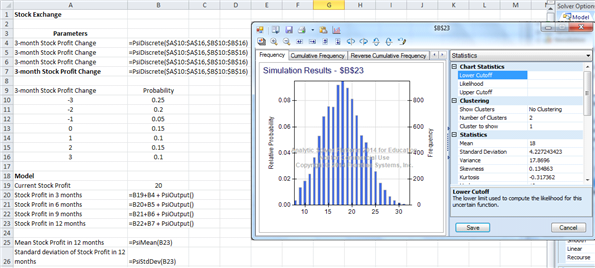

The stock price of Robin Tires, Inc., listed on the Stock Exchange is currently $20. The following probability distribution shows how the price per share is expected to change over a three-month period:

?

Stock Profit Change ($)

Probability

-3

0.25

-2

0.2

-1

0.05

0

0.15

+1

0.1

+2

0.15

+3

0.1

?

a. Construct a spreadsheet simulation model that computes the value of the stock profit in 3 months, 6 months, 9 months, and 12 months under the assumption that the change in profit over any 3-month period is independent of the change in profit over any other 3-month period.b. With the current profit of $20 per share, simulate the profit per share for the next four 3-month periods. What is the average profit in 12 months? What is the standard deviation of the profit in 12 months?

What will be an ideal response?

b. The mean stock profit after 12 months is $18 and the standard deviation is $4.20.

You might also like to view...

Flash Foods is the name of a chain of small stores, which carry high-turnover products such as lip balm, milk, soda, beer, bread, and aspirin. Flash Foods stores are open all day every day and would best be classified as convenience stores.

Answer the following statement true (T) or false (F)

Under the Family and Medical Leave Act, an individual manager who violates FMLA rights may be held personally liable

a. True b. False Indicate whether the statement is true or false

A finance lease is a long-term lease which meets one or more of the following criteria:

What will be an ideal response?

The _________ requires disclosure of a bank's privacy policy

a. Riegle-Neal Interstate Banking and Branching Efficiency Act b. Gramm-Leach-Bliley Act c. Financial Institutions Reform, Recovery and Enforcement Act d. Federal Deposit Insurance Corporation Improvement Act e. Depository Institutions Deregulation and Monetary Control Act