Discuss the financial statement impact of capitalizing versus expensing costs.

What will be an ideal response?

Capitalizing costs versus expensing has accounting implications that will affect net income as well as taxable income. Capitalizing costs means to record into an asset account, and then to account for the expiring of the asset through an adjusting entry to expense. This accounts for the cost on the balance sheet and then allocates the usage to expense on the income statement. Noting if this is a long-term asset, MACRS depreciation rules would be followed for income tax purposes. Costs that are directly expensed will be reported on the income statement, reducing net income as well as taxable income.

You might also like to view...

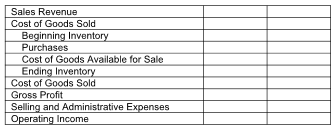

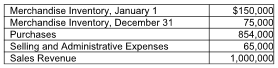

Required: Prepare Onyx's income statement for the year ended December 31, including the heading. Use the format provided below:

Onyx Corporation has provided the following information about its operating activities for the year:

Preparing a thorough analysis of each possible solution and selecting a course of action falls under the performing stage of the management process

Indicate whether the statement is true or false

Exhibit 4.1The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. Balance Sheet (Millions of $)Assets 2018 Cash and securities $3,000 Accounts receivable 15,000 Inventories 18,000 Total current assets $36,000 Net plant and equipment $24,000 Total assets $60,000 Liabilities and Equity Accounts payable $18,630 Accruals 8,370 Notes payable 6,000 Total current liabilities $33,000 Long-term bonds $9,000 Total liabilities $42,000 Common stock $5,040 Retained earnings 12,960 Total common equity $18,000 Total liabilities and equity $60,000 Income Statement (Millions of

$)2018Net sales $84,000 Operating costs except depreciation78,120 Depreciation 1,680 Earnings before interest and taxes (EBIT)$4,200 Less interest 900 Earnings before taxes (EBT) $3,300 Taxes 1,320 Net income $1,980 Other data: Shares outstanding (millions) 500.00 Common dividends (millions of $) $693.00 Int rate on notes payable & L-T bonds6% Federal plus state income tax rate40% Year-end stock price $47.52 ? Refer to Exhibit 4.1. What is the firm's total assets turnover? Do not round your intermediate calculations. A. 1.51 B. 1.15 C. 1.40 D. 1.06 E. 1.71

Thyne Inc. has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours.InputsStandard Quantity or Hours per Unit of OutputStandard Price or RateDirect materials 6.9grams$9.20per gramDirect labor 0.90hours$21.20per hourVariable manufacturing overhead 0.90hours$3.60per hour?The standard hours allowed for the actual output is closest to:

A. 3,092 hours B. 3,510 hours C. 3,330 hours D. 3,780 hours