U.S. tax laws allow taxpayers, in computing the amount of tax they owe, to use the real value, as opposed to the nominal value, of

a. both interest income and capital gains.

b. interest income but not capital gains.

c. capital gains but not interest income.

d. neither interest income nor capital gains.

d

You might also like to view...

International trade usually benefits one trading partner while making the other trading partner worse off

a. True b. False Indicate whether the statement is true or false

The development of the polio vaccine would be considered a(n) _____________________ to society.

Fill in the blank(s) with the appropriate word(s).

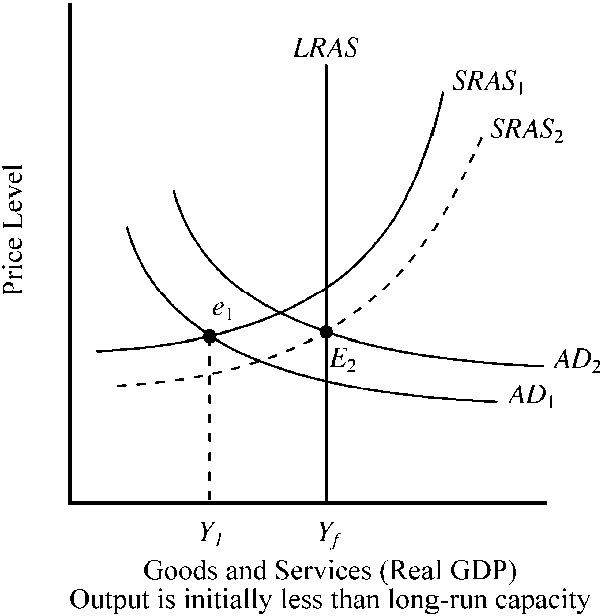

Figure 10-16

With the passage of time, which of the following will help direct this economy in toward its potential long-run rate of output?

a.

lower interest rates that will stimulate AD and lower resource prices that will increase SRAS

b.

higher interest rates that will reduce aggregate demand and higher resource prices that will reduce SRAS

c.

lower interest rates and higher resource prices, both of which will stimulate aggregate demand

d.

higher interest rates that will reduce SRAS and lower resource prices that will stimulate aggregate demand

For which reason is increasing the federal minimum wage not a good antipoverty program?

A. Roughly two-thirds of minimum wage earners are not the primary worker in their household. B. It is very costly for the government. C. The minimum wage discriminates against minorities. D. The minimum wage discriminates against the young. E. Increasing the federal minimum wage will likely increase employment opportunities.