Identify the type of merger in each of the following situations and indicate how the post-merger concentration ratio for the industry is affected

a. A steel company merges with a coal and iron ore mining company.b. Staples, a retailer of office supplies, acquires Office Depot, another retailer of office supplies.c. An oil company merges with pipeline, shipping, and railroad companies as well as refineries and gas stations.

a. This would be a vertical merger; the concentration ratio of the steel industry is not likely to change.

b. This is a horizontal merger; the concentration ratio would increase.

c. This is a vertical merger; the concentration ratio for the oil industry is not likely to change.

You might also like to view...

Suppose Always There Wireless serves 100 high-demand wireless consumers, who each have a monthly demand curve for wireless minutes of QdH = 200 - 100P, and 300 low-demand consumers, who each have a monthly demand curve for wireless minutes of QdL = 100 - 100P, where P is the per-minute price in dollars. The marginal cost is $0.25 per minute. Suppose Always There Wireless charges $0.30 per minute. If Always There Wireless charges the highest fixed fee that it can without losing the low-demand consumers, what is the profit from sales to each of the high-demand consumers?

A. $28.00 B. $24.50 C. $33.00 D. $28.13

True, false, or uncertain? Any firm that is not covering fixed costs should shut down in the short run

Indicate whether the statement is true or false

According to Fred Bateman and Thomas Weiss, in terms of industrial capacity in 1860, value added in manufacturing was close to _____ in the North, and _____ in the South

a. $500 million; $500 million b. $750 million; $500 million c. $1 billion; $400 million d. $1.6 billion; $193 million

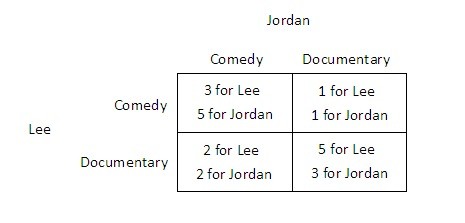

Suppose Jordan and Lee are trying to decide what to do on a Friday. Jordan would prefer to see a comedy while Lee would prefer to see a documentary. One documentary and one comedy are showing at the local cinema. The payoffs they receive from seeing the films either together or separately are shown in the payoff matrix below. Both Jordan and Lee know the information contained in the payoff matrix. They purchase their tickets simultaneously, ignorant of the other's choice.  This game:

This game:

A. is not a prisoner's dilemma. B. has no Nash equilibrium. C. is a prisoner's dilemma. D. is an ultimatum bargaining game.