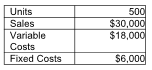

Saloli, Inc., provides the following information:

1) If Saloli increases its unit selling price by 5%, with no changes in variable costs and sales volume, its

new operating income will be ________.

2) If Saloli decreases its variable costs by $2 per unit, with no change in selling price per unit and sales

volume, its new operating income will be ________.

1. Unit selling price = Sales/Number of units = $30,000/500 = $60

Increasing by 5% = $60 × 1.05 = $63

Sales with new price= $63 × 500 = $31,500

Operating income = $31,500-$18,000-$6,000 = $7,500

2. Variable cost per unit = $18,000/500 = $36

Decrease by $2 = $36 - $2 = $34

New variable costs = $34 × 500 = $17,000

Operating income = $30,000 - $17,000 -$6,000 = $7,000

You might also like to view...

The best visual for illustrating a manufacturer's quality control process would be a

A) line chart. B) flowchart. C) table. D) pie chart. E) bar chart.

Industries with ________ significant competitors offer the best potential for using game theory

A) ten or more B) two or fewer C) five or more D) four or fewer

Which of the following account balances is not reported on the balance sheet?

a. Materials Inventory b. Manufacturing Patents c. Cost of Goods Sold d. Work in Process Inventory

Investors can use margin to acquire exchange-traded funds

Indicate whether the statement is true or false.