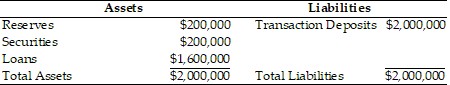

The potential money multiplier for the banking system in the above table is

The potential money multiplier for the banking system in the above table is

A. 5.

B. 1.

C. 10.

D. 9.

Answer: C

You might also like to view...

Which of the following are characteristics of market based regulations?

A) regulatory tripwires B) monitoring the value of a bank's subordinated debt instruments C) Market traders must have good information about depository institution risk. D) all of the above

The resource market involves transactions dealing with

a. natural resources and financial services. b. the borrowing and lending of financial capital. c. the buying and selling of final goods and services. d. labor services, natural resources, and physical capital.

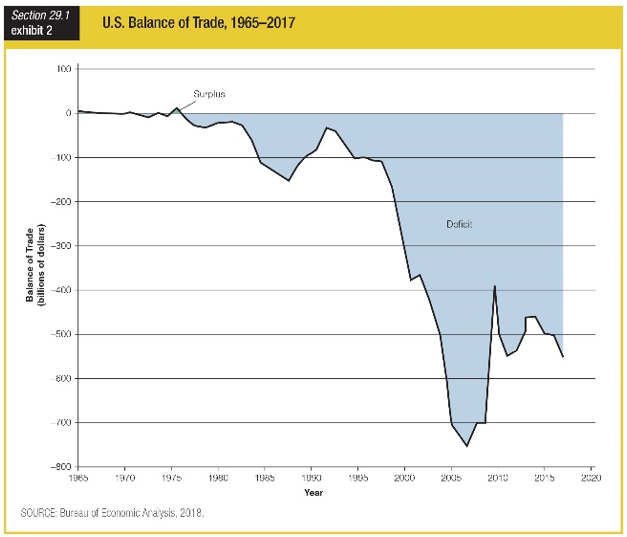

During which period did the United States experience a trade balance greater than -$700 billion on goods and services?

a. 1970–1979

b. 1980–1989

c. 1990–1999

d. 2000–2009

A problem that the Fed faces when it attempts to control the money supply is that

a. since the U.S. has a fractional-reserve banking system, the amount of money in the economy depends in part on the behavior of depositors and bankers.

b. the Fed has to get the approval of the U.S. Treasury Department whenever it uses any of its monetary policy tools.

c. while the Fed has the ability to change the money supply by a large amount, it does not have the ability to change it by a small amount.

d. federal legislation in the 1950s stripped the Fed of its power to act as a lender of last resort to banks.