Quantitative easing by the Fed refers to

A) the creation of bank reserves by engaging in large-scale open market operation at very low interest rates.

B) decreasing the money supply during a recession to prevent inflation.

C) selling private securities issued by the Fed.

D) lowering the federal funds rate while increasing the discount rate.

E) lowering the required reserve ratio to zero percent.

A

You might also like to view...

In the mid-1970s, changes in oil prices greatly affected U.S. inflation. When oil prices rose, the U.S. would experience ________.

A. cost-push inflation and falling output B. demand-pull inflation and falling output C. cost-push inflation and rising output D. demand-pull inflation and rising output

Monopsony firms will hire more workers than they would if the labor market were competitive

Indicate whether the statement is true or false

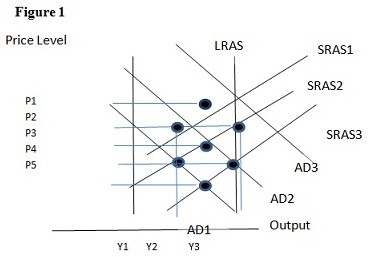

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the short run would be:

A. P1 and Y2. B. P3 and Y1. C. P2 and Y2. D. P2 and Y3.

Which of the following would not be included in the government consumption expenditures and gross investment (G) category of GDP?

A. The payments made to Social Security recipients. B. The expenditures made to repair a highway. C. The spending for professors at state universities. D. The purchase of new china for White House functions.