McGuire Company acquired 90 percent of Hogan Company on January 1, 2019, for $234,000 cash. This amount is reflective of Hogan's total acquisition-date fair value. Hogan's stockholders' equity consisted of common stock of $160,000 and retained earnings of $80,000. An analysis of Hogan's net assets revealed the following: Book Value Fair ValueBuildings (10-year life)$10,000 $8,000 Equipment (4-year life) 14,000 18,000 Land 5,000 12,000 ??Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years.?In consolidation at January 1, 2019, what adjustment is necessary for Hogan's Patent account?

A. $9,900.

B. $11,000.

C. $7,000.

D. $6,300.

E. No adjustment is necessary.

Answer: B

You might also like to view...

Stakeholder is a person who has an interest and investment in an organization and expects a return on the investment in the form of “perks,” free tickets, meals, etc.

a. True b. False

In a decentralized company, all the planning and controlling decisions are made by top management

Indicate whether the statement is true or false

Bridge Company makes special equipment used in cell towers

Each unit sells for $410. Bridge uses just-in-time inventory procedures; it produces and sells 12,000 units per year. It has provided the following income statement data: Traditional Format Contribution Margin Format Sales revenue $4,920,000 Sales revenue $4,920,000 Cost of goods sold 2,900,000 Variable costs: Gross profit 2,020,000 Manufacturing 1,000,000 Selling & admin. expenses 650,000 Selling & admin. 400,000 Contribution margin 3,520,000 Fixed costs: Manufacturing 1,900,000 Selling & admin. 250,000 Operating income $1,370,000 Operating income $1,370,000 A foreign company has offered to buy 100 units for a reduced sales price of $300 per unit. The marketing manager says the sale will have no negative impact the company's regular sales. The sales manager says that this sale will not require any additional selling and administrative costs, as it is a one-time deal. The production manager reports that there is plenty of excess capacity to accommodate the deal without requiring any additional fixed costs. If Bridge accepts the deal, how will this impact operating income? (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.) A) Operating income will increase by $29,917. B) Operating income will decrease by $29,917. C) Operating income will increase by $30,000. D) Operating income will decrease by $30,000.

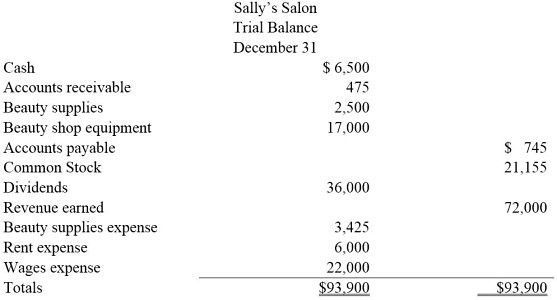

Based on the following trial balance for Sally's Salon, prepare an income statement, statement of retained earnings, and a balance sheet. Sally Crawford, the sole stockholder, made no additional investments in the company during the year.

What will be an ideal response?