A progressive income tax system can be defined as one in which

A. the government uses taxes paid by the wealthy to fund programs for the poor.

B. an individual pays more dollars in taxes when his income rises.

C. the marginal tax rate rises over time.

D. the average tax rate is higher for individuals with higher incomes.

Answer: D

You might also like to view...

We say that individuals get a "warm glow" from giving to a public good if they not only get utility from the public good but also from giving itself. Explain the following: "While warm glow lessens the free rider problem, it cannot eliminate it."

What will be an ideal response?

According to your textbook, globalization tends to increase the productivity of nations through

A) improvements in the labor skills of their citizens. B) increasing technological knowledge. C) improving the coordination of individual economic plans. D) doing all of the above.

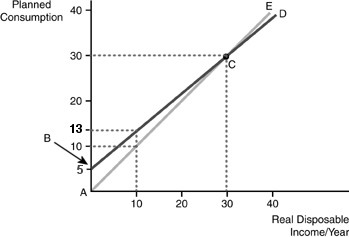

Refer to the above figure. Line ACE is called

Refer to the above figure. Line ACE is called

A. the savings function. B. the 45-degree line. C. the saving function. D. the consumption function.

Lauren runs a chili restaurant in San Francisco. Her total revenue last year was $110,000. The rent on her restaurant was $48,000, her labor costs were $42,000, and her materials, food and other variable costs were $20,000. Lauren could have worked as a biologist and earned $50,000 per year. An economist calculates her implicit costs as _____

A. $20,000 B. $30,000 C. $40,000 D. $50,000