A government is thinking about increasing the sales tax rate. Should it use static or dynamic tax analysis? Explain why one approach is better than the other

What will be an ideal response?

The government should use dynamic tax analysis. When estimating the expected revenue generated by the sales tax, it is important to remember that the tax base could be influenced. If the tax base decreases sufficiently in response to a tax-rate increase, total revenues may be reduced even though there has been an increase in the sales tax rate.

You might also like to view...

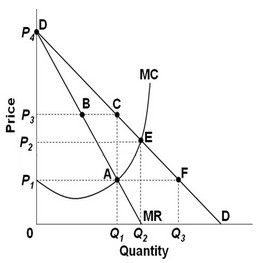

Use the following graph to answer the next question.  If the industry were served by a pure monopoly, the profit-maximizing price and quantity of output would be ________.

If the industry were served by a pure monopoly, the profit-maximizing price and quantity of output would be ________.

A. P1, Q1 B. P1, Q3 C. P3, Q1 D. P2, Q2

The government of Poorland increased its expenditure following a recession. This is likely to lead to ________

A) higher interest rates B) an increases in demand for labor C) a decrease in the price level D) lower real wages

A perfectly competitive firm is producing at the point where its marginal cost equals its marginal revenue. If the firm boosts its output, its total revenue will ________ and its profit will ________

A) rise; rise B) rise; fall C) fall; rise D) fall; fall

Which of the following is not an explanation for the revival in the growth of productivity starting in the mid-1990s?

A) Cell phones and wireless Internet access have increased worker flexibility. B) Internet use has increased the efficiency of how firms buy and sell to each other and to consumers. C) Information and communication innovations are increasingly geared toward improving business processes and not consumer products. D) Faster computers have sped up data processing.