A tax on a previously untaxed monopoly-produced good will necessarily lower total welfare if

A) the demand curve is relatively inelastic.

B) the demand curve is relatively elastic.

C) less than the socially optimum is produced before the tax.

D) more than the socially optimum is produced before the tax.

C

You might also like to view...

If the slope of the aggregate expenditure curve is 0.75, the expenditure multiplier is equal to

A) 1.33. B) 4.00. C) 0.75. D) 0.25. E) 5.00.

If the yen price of dollars falls, then the dollar price of yen rises

a. True b. False Indicate whether the statement is true or false

If the inflation rate is zero, then

a. both the nominal interest rate and the real interest rate can fall below zero. b. the nominal interest rate can fall below zero, but the real interest rate cannot fall below zero. c. the real interest rate can fall below zero, but the nominal interest rate cannot fall below zero. d. neither the nominal interest rate nor the real interest rate can fall below zero.

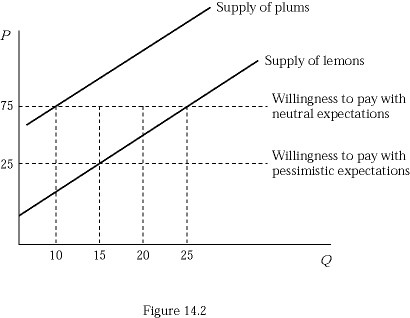

Figure 14.2 represents the market for used cameras. Suppose buyers are willing to pay $125 for a plum (high-quality) used camera and $25 for a lemon (low-quality) used camera. If buyers believe that 50% of used cameras in the market are lemons (low quality), how many lemons (low quality) will be supplied by sellers?

Figure 14.2 represents the market for used cameras. Suppose buyers are willing to pay $125 for a plum (high-quality) used camera and $25 for a lemon (low-quality) used camera. If buyers believe that 50% of used cameras in the market are lemons (low quality), how many lemons (low quality) will be supplied by sellers?

A. 10 B. 15 C. 20 D. 25