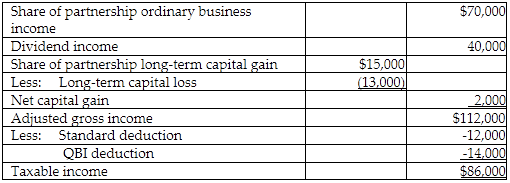

MN Partnership has two equal partners, Mark and Nadia. In the current year, the MN earns $140,000 of ordinary business income and a $30,000 long-term capital gain. Nadia is single. In addition to the partnership items, she reports $40,000 of dividend income and a long-term capital loss of $13,000 from her personal investment accounts. Nadia does not itemize her deductions. Calculate Nadia's 2018

taxable income.

What will be an ideal response?

You might also like to view...

A transaction in which six months' rent is paid in advance results in which of the following journal entries?

a. Prepaid Rent – Debit; Cash – Credit b. Rent Receivable – Debit; Cash – Credit c. Rent Revenue – Debit; Cash – Credit d. Rent Expense– Debit; Cash – Credit

The first state court to consider the issue of same sex marriages was:

a) Vermont b) Massachusetts c) California d) Hawaii e) NOTA

The weight of football players is normally distributed with a mean of 200 pounds and a standard deviation of 25 pounds. What percent of players weigh between 180 and 220 pounds?

a. 28.81% b. 0.5762% c. 0.281% d. 57.62%

An employee whose regular hourly rate is $12 and whose overtime rate is 1.5 times the regular rate worked 45 hours in one week. The employer should record an overtime premium of ________ in the payroll register.

Fill in the blank(s) with the appropriate word(s).