In recent decades, the fiscal tool most often chosen by policymakers has been tax reductions.

What will be an ideal response?

s. (Tax reductions, of course, tend to be politically popular in addition to providing economic stimulus.) Increases in transfer payments would have the same general positive effect on aggregate demand. The opposite policies—increasing taxes or decreasing transfer payments—would have a negative effect on economic equilibrium, similar to a reduction in government spending

You might also like to view...

A consumer has $20 that he wants to spend on two goods: pens priced at $2 each, and pencils priced at $1 each. Which of the following correctly represents his budget constraint?

A) $20 = ($2/Quantity of pens) + ($1/Quantity of pencils) B) $20 = ($2 × Quantity of pens) + ($1 × Quantity of pencils) C) $20 = ($3/Quantity of pens + Quantity of pencils) D) $20 = $3 × (Quantity of pens - Quantity of pencils)

There were more poor people in America in 2005 than there were in 1965

Indicate whether the statement is true or false

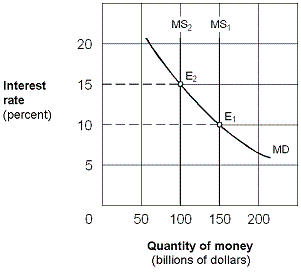

Exhibit 20-1 Money market demand and supply curves

?

A. sell bonds and drive the price of bonds down. B. sell bonds and drive the price of bonds up. C. buy bonds and drive the price of bonds down. D. buy bonds and drive the price of bonds up.

Recall the Application about the use of fertilizer and its impact on crop yields to answer the following question(s). The table is taken from this Application. Bags of Fertilizer Bushels of Corn0851120213531444147Refer to the table above. After applying the second bag of fertilizer, the farmer experienced:

Bags of Fertilizer Bushels of Corn0851120213531444147Refer to the table above. After applying the second bag of fertilizer, the farmer experienced:

A. increasing returns. B. diminishing returns. C. constant returns. D. negative returns.