A tax whose burden, expressed as a percentage of income, increases as income increases is

A. a progressive tax.

B. an ability-to-pay tax.

C. a regressive tax.

D. a proportional tax.

Answer: A

You might also like to view...

The single currency project in the EU will be most successful if European labor is relatively

A) immobile. B) immobile and business cycles are not synchronized. C) mobile and business cycles are synchronized. D) mobile and business cycles are not synchronized. E) mobile.

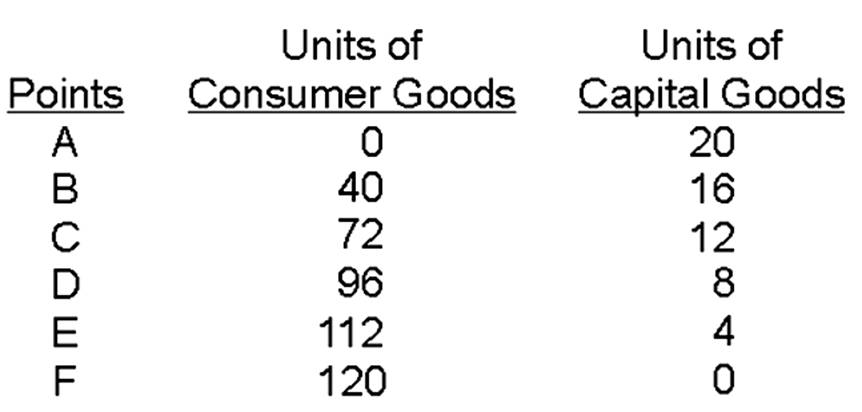

If the economy produces 12 capital goods and 40 consumer goods,

Hypothetical Production Schedule for a Two-Product Economy

A. it is producing outside its production possibilities curve.

B. this combination of output will most likely result in economic growth.

C. the ability to produce more consumer goods can only be realized by sacrificing capital goods.

D. this economy has some unemployed resources.

A monopolist finds the output (Q*) rate that maximizes profit. It finds the price by

A) taking the height of the marginal revenue curve at output rate Q. B) taking the height of the marginal cost curve at output rate Q. C) taking the height of the demand curve at output rate Q. D) setting price equal to marginal cost.

In 2013 the United Nations concluded that global warming

A. Was not scientifically proven. B. Was not occurring. C. Was the result of human activity with a 95 percent certainty. D. Was not caused by human activity.