Which of the following does NOT describe the intended purpose of the antitrust laws of the United States?

A) to promote competition within the economic system

B) to reduce the power of monopolies

C) to prohibit certain economic activities that promote trade

D) to restrict the formation of monopolies

Answer: C

You might also like to view...

Which of the following best explains why the federal tax rebates in 2008 and 2009 had almost no effects on aggregate demand?

A) According to Ricardian equivalence theorem, those tax rebates did not affect aggregate demand because they were accompanied by more government spending. B) According to the permanent income hypothesis, those one-time tax rebates did not affect consumption because taxpayers did not believe the rebates would occur. C) According to Ricardian equivalence theorem, those tax rebates did not affect aggregate demand because there were no direct expenditure offsets. D) According to the permanent income hypothesis, those one-time tax rebates did not affect consumption because they did not change taxpayers' permanent income.

Although the FDIC was created to prevent bank failures, its existence encourages banks to

A) take too much risk. B) hold too much capital. C) open too many branches. D) buy too much stock.

The critical determinant of real GDP per capita is

A) the size of the labor force. B) labor productivity. C) the population. D) the size of the working-age population.

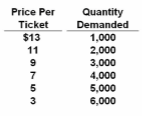

Refer to the information. Over the $9-$7 price range, demand is:

A. perfectly elastic.

B. perfectly inelastic.

C. elastic.

D. inelastic.