A welfare recipient receives $10,000 in benefits when he does not work but receives an income of $15,000 when he works part-time and earns $6,000 in wages. What is the implicit marginal tax rate the recipient faces?

A. 15.5 percent.

B. 0 percent.

C. 16.6 percent.

D. 100 percent.

Answer: C

You might also like to view...

The economy represented in the graph above has

A) low capital mobility. B) high capital mobility. C) perfect capital mobility. D) increasing capital mobility.

An expectation that encourages people to behave in a certain way

a. free enterprise b. traditional economy c. incentive d. safety net e. socialism

Which of the following is not a leading actor in labor markets?

A. workers B. government C. firms D. consumers E. unions

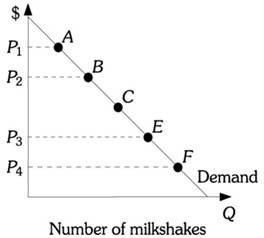

Refer to the information provided in Figure 5.4 below to answer the question(s) that follow. Figure 5.4Refer to Figure 5.4. Along the given demand curve, which of the following is true?

Figure 5.4Refer to Figure 5.4. Along the given demand curve, which of the following is true?

A. Since the demand curve is linear, the price elasticity of demand between each of the points is the same. B. Demand is less elastic along the segment EF than the segment AB. C. Demand is less elastic along the segment AB than the segment EF. D. All of the above are true.