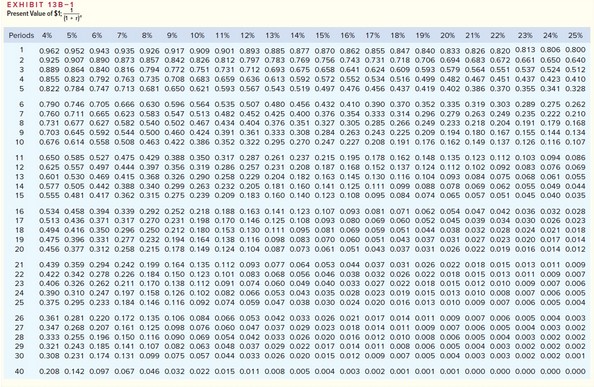

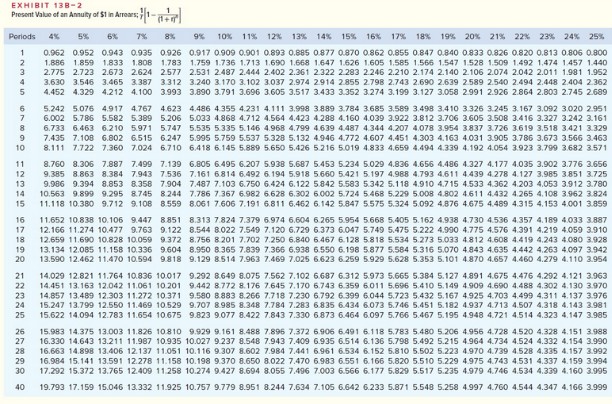

The management of Osborn Corporation is investigating an investment in equipment that would have a useful life of 8 years. The company uses a discount rate of 12% in its capital budgeting. The net present value of the investment, excluding the annual cash inflow, is ?$405,414. To the nearest whole dollar how large would the annual cash inflow have to be to make the investment in the equipment financially attractive? (Ignore income taxes.)Use Exhibit 13B-1 and Exhibit 13B-2 above to determine the appropriate discount

The management of Osborn Corporation is investigating an investment in equipment that would have a useful life of 8 years. The company uses a discount rate of 12% in its capital budgeting. The net present value of the investment, excluding the annual cash inflow, is ?$405,414. To the nearest whole dollar how large would the annual cash inflow have to be to make the investment in the equipment financially attractive? (Ignore income taxes.)Use Exhibit 13B-1 and Exhibit 13B-2 above to determine the appropriate discount

factor(s).

A. $81,605

B. $48,650

C. $50,677

D. $405,414

Answer: A

You might also like to view...

A "think-local, act-local" multidomestic strategy works particularly well in all of the following situations, except when there are

A. significant country-to-country differences in distribution channels and marketing methods. B. regulations enacted by the host governments requiring that products sold locally meet strictly defined manufacturing specifications or performance standards. C. diverse and complicated trade restrictions of host governments preclude the use of a uniform strategy from country-to-country. D. significant country-to-country differences in customer preferences and buying habits. E. large demands to pursue conflicting objectives simultaneously.

Which of the following is an activity ratio?

a. the acid-test ratio b. the accounts-receivable-turnover ratio c. the current ratio d. the return-on-sales ratio e. the return-on-activity ratio

In general, it's better to have a low inventory turnover ratio than a high one, as a low ratio indicates that the firm has an adequate stock of inventory relative to sales and thus will not lose sales as a result of running out of stock.

Answer the following statement true (T) or false (F)

_____ refers to the moral principles or values that generally govern the conduct of an individual or a group.

A. Righteousness B. Social consensus C. Sustainability D. Virtue E. Ethics