Suppose you borrow $2,000 for one year and at the end of the year you repay the $2,000 plus $110 of interest. The expected inflation rate was 2.2% at the time you took out the loan, but the actual inflation rate turned out to be 3.3%

What was the actual real interest rate you paid? A) 2.2%

B) 3.3%

C) 5.5%

D) 8.8%

A

You might also like to view...

The following appeared in a Florida newspaper a week after a hurricane hit the state. "Floridians are relieved that the storm produced no fatalities but homeowners face weeks, if not months, of rebuilding. Matters are made worse by the soaring prices of plywood and other building materials that always follow in a hurricane's path. Complaints of profiteering and price gouging have not deterred firms from raising their prices by over 100 percent." Which of the following offers the best explanation for the price increases referred to in the article?

A) The hurricane caused an increase in the demand for building materials. B) The hurricane created an artificial shortage of building materials. C) There was a reduction in supply as firms shipped plywood and other materials to locations not affected by the storm. D) The hurricane reduced the number of suppliers of building materials.

Rationing occurs for goods

A) that have a positive price. B) that have a zero price. C) that have a negative price. D) that are not manufactured.

Unanticipated inflation penalizes: a. those who are saving

b. those who are borrowing. c. governments. d. those who are in high-growth industries where wages are growing faster than prices. e. those who can't find jobs at any wage rate.

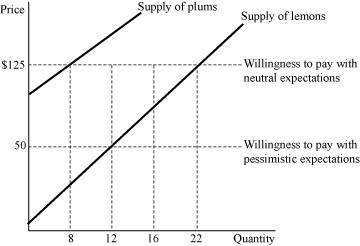

Figure 9.1 represents the market for used bikes. Suppose buyers are willing to pay $200 for a plum (high-quality) used bike and $50 for a lemon (low-quality) used bike. If buyers believe that 50% of used bikes in the market are lemons (low quality), what fraction of used bikes sold will actually be plums (high quality)?

Figure 9.1 represents the market for used bikes. Suppose buyers are willing to pay $200 for a plum (high-quality) used bike and $50 for a lemon (low-quality) used bike. If buyers believe that 50% of used bikes in the market are lemons (low quality), what fraction of used bikes sold will actually be plums (high quality)?

A. 8/30 B. 22/30 C. 8/22 D. 30/30