An unanticipated shift to a more expansionary monetary policy by the Fed will

a. increase real interest rates and, thereby, reduce investment, current consumption, and aggregate demand.

b. reduce real interest rates, leading to an appreciation of the dollar and an expansion in net exports and aggregate demand.

c. increase real interest rates, leading to higher asset prices that will stimulate aggregate demand.

d. reduce real interest rates and, thereby, stimulate investment, current consumption, and aggregate demand.

D

You might also like to view...

If the price of rocket fuel imported from Russia and used by NASA suddenly increases, then the U.S. CPI will ________ and the U.S. GDP deflator will ________

A) increase; not change B) increase; increase by more than the CPI C) not change; increase D) increase; increase E) not change; not change

The assumption of diminishing marginal rate of substitution means that

A) the budget line has a negative slope. B) the budget line does not shift when people's preferences change. C) indifference curves might have a positive slope. D) indifference curves will be concave.

Which of the following is considered a microeconomic issue?

A. Chinese economic growth has declined. B. The Federal Reserve cuts key interest rates in order to stimulate lending. C. Walmart decides to add more self-checkout machines as the cost of labor rises. D. India experiences a reduction in unemployment after opening its borders to trade.

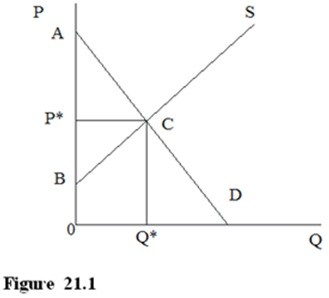

In Figure 22.2, which area represents consumer surplus to the smoker?

A. 0ACQ* B. 0P*CQ* C. 0BCQ* D. AP*C